Central Bank Digital Currencies (CBDC) is a digital currency issued by and a liability of a country’s central bank. To the general public, CBDC is the digital form of physical cash. From the perspective of banks, CBDC can be used to settle interbank payments and transactions, like electronic bank reserves held at the central bank.

What are the considerations when designing CBDC?

• Token or Account-based

• Interest bearing

• Accessibility – Wholesale or Retail

• Single-tier or Two-tier model

Token or account based

An account-based CBDC model maintains a record of all accounts and corresponding balances, which are each tied to holders with known identities. A token-based CBDC model keeps a record of objects of value (“tokens”), each of which are controlled by holders whose identities could be known or unknown.

Between the two, a token-based model offers greater anonymity, though still less than physical cash because there would still be an electronic trail. The less stringent user-identity requirements, in the case of token-based model, also make it easier to achieve wider accessibility, potentially including foreign entities (e.g. tourists, foreign banks) to own and use.

Interest bearing

Unlike physical cash, there is the option of applying an interest rate to CBDCs. By extension, this gives the central bank the ability to influence monetary policy transmission, including reducing the lower bound on policy rates to below zero.

Accessibility – Wholesale or Retail

Central banks need to decide if usage of CBDCs would be limited to banks and other financial institutions (“Wholesale”) or be made available to the general public, including inpiduals (“Retail”). Central banks also need to decide if they want to extend usage to non-residents and foreigners (e.g. tourist, foreign banks).

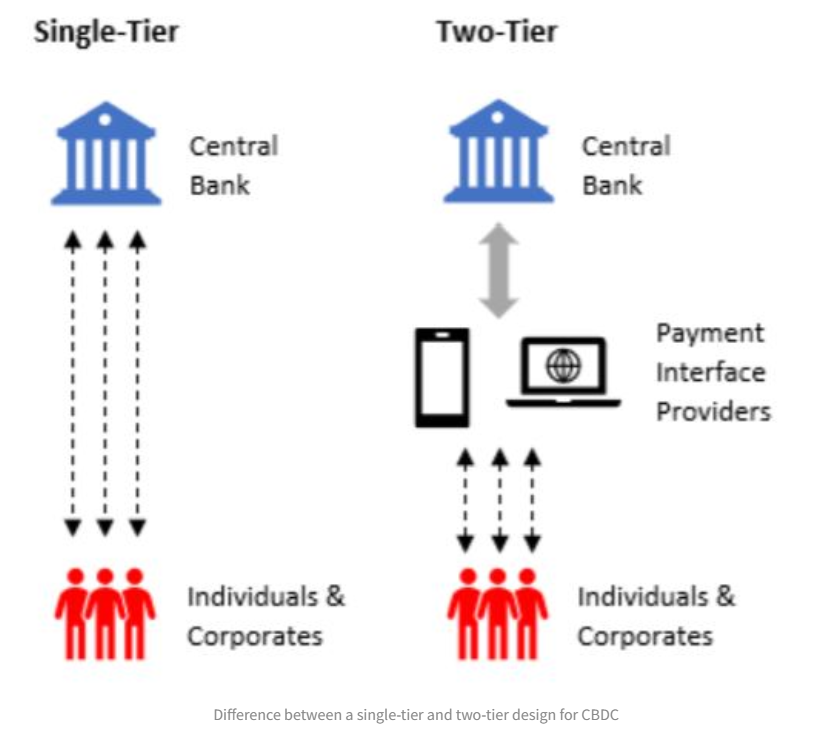

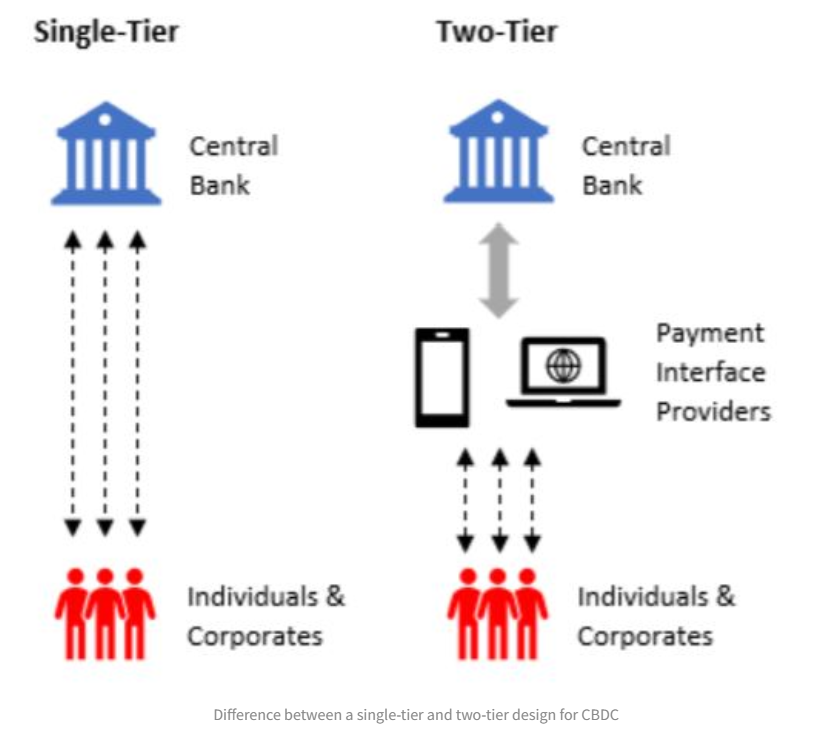

Single-tier or Two-tier model

Central banks need to decide on the level of operational involvement of the private sector.

In a single-tier model, the central bank would be responsible for all tasks, from start to end. In our view, a single-tier model would be challenging for many countries as central banks may lack the capacity or expertise in customer-facing functions such as screening customers, servicing accounts and providing important complementary services such as e-commerce.

A two-tier model is likely to be more common. In a two-tier model, the central bank outsources some of the tasks to commercial banks who essentially functions as payment interface providers. It is likely that central banks would want to control the issuance and redemption of CBDCs.

Distribution, payment services and managing of user accounts/wallets could then be handled by commercial banks. Compared to the single-tier model, the two-tier model entails lower risks of bank disintermediation and allows commercial banks to continue to leverage on their competitive advantages in customer-facing functions.

The following illustration shows the difference between a single-tier and two-tier design model for CBDC.

Centralized ledger versus decentralized ledger technologies

Within each possible tier of the CBDC model (central bank to users, central bank to payment interface providers and payment interface providers to users), there is also the choice of centralized vs decentralized ledgers.

In the case of a centralized ledger, the payer would connect to the central ledger keeper when initiating a payment/transfer to the recipient. The central ledger keeper would then be responsible for verification of funds availability and updating the ledger. In the case of a decentralized ledger, the ledger is replicated and shared across several trusted and selected participants within a permissioned network (we judge it unlikely that public/permission-less networks, like Bitcoin, will be commonly implemented).

Assuming a two-tier model, in the tier where central bank and selected payment interface providers sits, transactions could take place on the central bank’s balance sheet (centralized ledger), with the central bank serving as ledger keeper. The tier where payment interface providers serve end-users (retail customers) could involve some extent or incorporate some elements of decentralized ledger technologies, such as cryptography (to enhance privacy and security) and programmability.

The important difference between CBDCs and cryptocurrencies are that CBDCs will still largely be controlled by the central bank. They could be managed in a distributed ledger, but ownership determination is not through a consensus protocol, unlike cryptocurrencies. Furthermore, their issuance and value will be determined by policies, not algorithms.

CBDC developments

Central banks around the world have been preparing for the possible issuance of digital currencies. A 2019 survey by the Bank of International Settlement (BIS) of 66 central banks, 80% responded that they are engaging in some sort of work on a CBDC. About 40% said that they have progressed from research to experiments, and 10% have developed pilot projects.

Some recent CBDC-related developments this year:

- July - The Bank of Japan announced that it will begin experimenting with a CBDC, to check its feasibility from a technical perspective.

- June - The Bank of Thailand announced the project to develop the prototype of the payment system for businesses using CBDC.

- April - The People’s Bank of China started the internal tests of a CBDC, named the digital currency electronic payment (DCEP), in four cities - Suzhou, Shenzen, Xiong’an and Chengdu.

- April - The Bank of Korea launched a 22-month pilot programme to assess the issuance of a CBDC.

- February - Sweden’s Riksbank began to test its CBDC (e-krona).

CBDC pilots

The potential benefits of CBDCs for end users would include increased safety and efficiency. CBDCs would also offer benefits for central banks. There are arguments that CBDCs may strengthen the pass-through of policy rate to money and lending markets. They could also alleviate the zero-bound constraint. Another argument is that in countries where a sizable portion of the population does not participate in the formal financial system, CBDCs could improve financial inclusion.

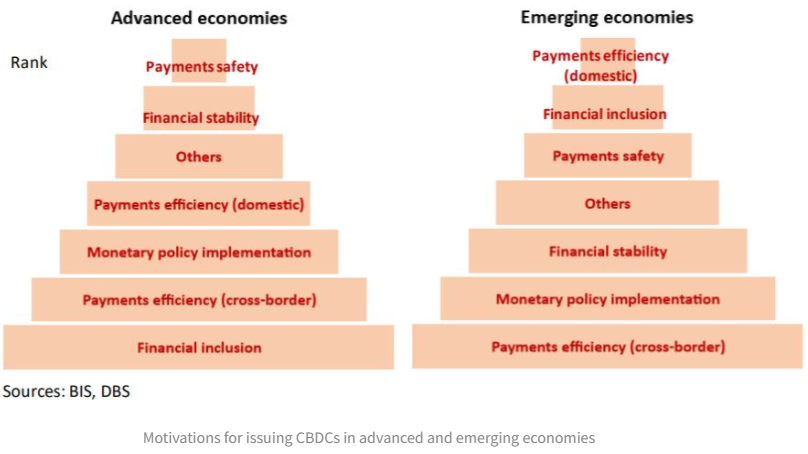

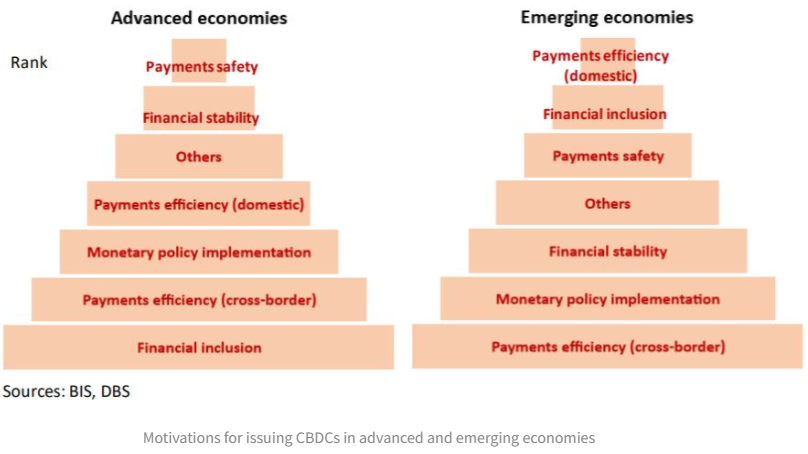

According to a 2019 BIS survey, payments safety and domestic payments efficiency are the most important motivations for central banks to issue CBDCs. When breaking down motivations by economic development, for general CBDCs, emerging economies are largely motivated by not only domestic payments efficiency but also financial inclusion. Advanced economies, on the other hand, are motivated by payments safety and financial stability, while financial inclusion is the least important factor.

Sweden and Uruguay are notable for their progress on general purpose CBDCs. In Sweden, the Riksbank is working on issuing an e-Krona, a form of electronic payment that would be an alternative to cash. This is largely in response to the declining usage of cash in Sweden, and the state’s need to have a role in the payment market.

Retailers in Sweden may also respond to the increasingly prohibitive cost of accepting cash by refusing to accept it in the future, and thus those who do not use electronic payments besides cards, such as the elderly, will need an alternative method of payment.

In Uruguay, the central bank has completed a pilot programme on a general purpose CBDC, which aims to improve financial inclusion. These goals resulted in the central bank issuing and circulating the e-Peso as part of the pilot programme as a complement to physical cash.

The Monetary Authority of Singapore (MAS) announced the successful development of a blockchain-based prototype co-developed in collaboration with J.P. Morgan and Temasek that enables payments to be carried out in different currencies on the same network. Hopefully, it will improve cost efficiencies for businesses.

Article contributed by Taimur Baig and Team, DBS Bank and extracted from DBS Bank’s " Digital Currencies: Public and Private, Present and Future" report

By Taimur Baig and Team, DBS Bank

DBS Bank’s "Digital Currencies: Public and Private, Present and Future" report

.png?sfvrsn=7a1194d1_1)

Overview

Overview

.png?sfvrsn=86556ebb_1)

.png?sfvrsn=a8212bcc_1)

.png?sfvrsn=858c63d1_1)

2b4307cf-e91f-4368-ac62-cf234d6d2b1c.png?sfvrsn=212575fd_1)