Developing Future-Enabled Skills

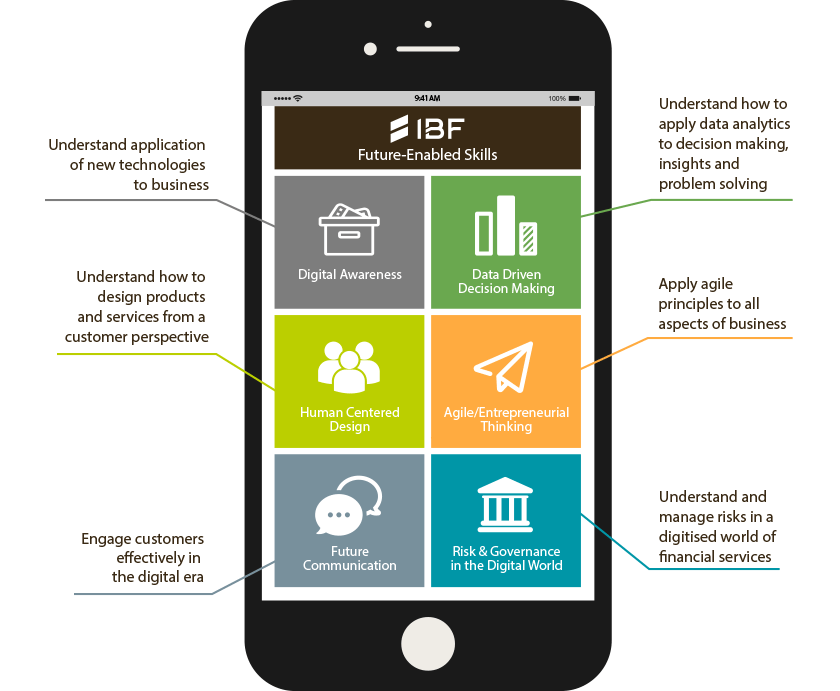

IBF will be recognising a suite of horizontal capabilities under its IBF Standards for the first time. Referred to as Future-Enabled Skills, these new capabilities have been identified by industry leaders as critical to equip financial practitioners for the increasing digitalisation of the industry. IBF will initially have six pillars under the Future-Enabled Skills, which will cover digital awareness, data driven decision making, human centered design, agile/entrepreneurial thinking, future communication, as well as risk and governance in the digital world. To ensure that training for these Future-Enabled Skills remains current, IBF will work with industry leaders to update the modules under each pillar and consider the need for additional pillars over time.

IBF will also introduce a Mobile Micro-Learning App to complement in-depth facilitated training. Financial institutions will be able to subscribe to this new platform, so that their staff will have access to content on Future-Enabled Skills. Comprising short modules of not more than 10 minutes each, financial practitioners will be able to learn about these new areas while on-the-go.

The IBF Mobile Learning Platform - Learn@IBF

Benefits for Financial Institutions

Cost-Effective

Curated Content

Data Analytics

Multi-Device

Benefits for Financial Practitioners

Fresh & Compelling Content

Learn from Thought Leaders

Engagement with Peers

New Industry Skills Roadmaps

Given the rapid and transformational changes across jobs, IBF has started to refine its existing competency framework for accreditation and certification. Among the changes, IBF will incorporate cross-functional and digital capabilities in addition to financial sector specific expertise.

IBF will also adopt a skills-based approach, and allow individuals to acquire competencies (or skills) required for their jobs. This will be a departure from the current approach where a pre-determined set of competencies are specified for each role. A skills-based approach will also allow financial practitioners to more easily identify additional skills needed to transit into new or adjacent roles.

Consumer Banking

Consumer Banking

IBF has worked with the Consumer Banking Working Group to develop a set of skills-based competency standards for the industry. The standards seek to equip individuals with skills to facilitate progression and transition to emerging roles as consumer banking becomes increasingly digital. Analytics and decision sciences, digital channel and design and digital engagement and marketing will be introduced as new skills alongside existing functional skills in sales, customer interaction, product development and business assurance.

IBF is working with the key consumer banks to recognise their in-house programmes against the IBF Standards for the upskilling of their staff. IBF will also engage external training providers to customise programmes to develop the new skills.

Ngee Ann Polytechnic is developing a Specialist Diploma in Consumer Banking as part of the SkillsFuture Earn and Learn Programme (ELP). This Specialist Diploma will be aligned to the new Consumer Banking Standards.

“In partnership with IBF, the Consumer Banking Working Group has shifted the focus of the review from Job certification to Skills certification for the Consumer Banking industry. This is particularly crucial as consumer banking roles are increasingly utilizing a variety of skills at various levels in areas such as data analytics and user experience design among others, in addition to core banking knowledge. Hence, it is more meaningful to certify the depth of skills competency by levels. This will also create stronger adaptability for individuals as these skills can be applied to different roles as well as open up more career paths and opportunities for them. It has been a privilege to work with IBF on this journey of transformation and we look forward to the successful adoption of the Standards.”

Fund Management

Fund Management

The Fund Management Standards have been expanded to incorporate alternative investments and hedge funds. In addition to core knowledge components, the Fund Management Working Group has also decided to include a broad range of elective skills, such as environmental and social governance and data science that may become relevant in the near future. The new Fund Management Standards will recognise programmes that equip individuals with practical skills for jobs in the fund management industry, and will complement programmes such as CFA and CAIA which require a longer duration of study. To the extent that there are overlaps, IBF will recognise individuals who have successfully completed the CFA or CAIA programmes under the new Fund Management Standards.

“The fund management industry has arrived at an inflection point, where competencies must respond to secular trends in demographics, social responsibilities, changing regulations, digital disruption and evolving distribution models. The new fund management competency framework is based on a core-plus approach, where core fund management competencies can be dynamically combined with emerging skills required for tomorrow's environment. This will in turn help develop an adept talent base that stays ahead as our industry evolves.”

Private Banking

Private Banking

In response to changes impacting the Private Banking industry, the Private Banking Industry Group (PBIG) undertook a review of the competencies required of Private Banking Relationship Managers (RM) last year. PBIG subsequently recommended that RMs in Singapore would need to have skillsets to meet the increasingly sophisticated and diverse needs of clients, adapt and learn to leverage digital technologies and navigate a complex regulatory environment. IBF will be reviewing the Private Banking Standards in 2017 and is considering the introduction of new competencies on digital, cross-banking and market knowledge, as well as a new management track focusing on team leadership and managerial functional skills for senior RMs.

Industry Partnerships

IBF will continue to review the IBF Standards in partnership with the industry to identify structured progression pathways for evolving job segments and ensure financial industry practitioners deepen capabilities and master new skillsets. As a member of the Financial Sector Tripartite Committee (FSTC), IBF is committed to supporting initiatives by the Financial Industry Career Advisory Centre (FiCAC) to facilitate mobility of displaced professionals. IBF will also partner Workforce Singapore in implementing Professional Conversion Programmes (PCP) in areas such as Compliance, where there is demand for specialist expertise as regulatory standards are raised.

MySkills Portfolio: Helping Individuals manage their Learning Journey

IBF launched MySkills Portfolio in Jan 2017. By creating an individual account in the IBF Portal, individuals will be able to register for exams, set training goals, track their training progress and receive programme recommendations based on these goals. Training records of individuals submitted by financial institutions or training providers for funding claims or CPD reporting will also be automatically reflected in the individual’s account. This will facilitate self-directed learning, and provide practitioners with an overview of their training records and skills as they transition across roles and/or employers.

MySkills Portfolio

My Dashboard

Overview of your exam, training and certification progress

My Goals

Set your career goals here

My Exams

Register for Exams

Retrieve your exam records

My Training

Obtain training programme recommendations based on your goals

Keep track of your training

My Certification

Plan for your IBF Certification

My Profile

Update your details