The Institute of Banking and Finance Singapore (IBF) was established in 1974 as a not-for-profit industry association to foster and develop the professional competencies of the financial industry. IBF represents the interests of close to 200 member financial institutions including banks, insurance companies, securities brokerages and asset management firms. In partnership with the financial industry, government agencies, training providers and the trade unions, IBF is committed to equip practitioners with capabilities to support the growth of Singapore’s financial industry.

IBF is the national accreditation and certification agency for financial industry competency in Singapore under the Skills Framework for Financial Services, which were developed in partnership with the industry. Since 2018, IBF is the appointed programme manager for the administration of professional conversion programmes for the financial industry under Workforce Singapore’s Adapt and Grow initiative.

IBF also provides personalised career advisory and job matching services to Singapore Citizens and Singapore Permanent Residents exploring a new role in, or career switch into the financial industry, under IBF Careers Connect.

Since mid-October 2020, IBF has been appointed by the National Jobs Council as the Jobs Development Partner for the financial industry.

The IBF Council provides strategic direction and sets major policies of the Institute. The Council comprises representatives from financial institutions of local and foreign banks, industry associations and government agencies. The Council typically meets three to four times a year to review business policies and progress and ensure that this is aligned to the Institute’s objectives to foster and develop professional competencies for the financial services industry.

In 2020, the Council held 4 meetings. The attendance of the meetings is as follows:

The Council elects from its members a Chairman and Vice Chairman, and appoints one member as Chairperson of the IBF Standards Committee and three of its members each to the Audit Committee and to the Investment Committee. The Investment Committee was dissolved in February 2020.

The Committee Chairman and members have relevant qualifications and/or experience to provide effective oversight. Council members do not receive any remuneration for their service to the Institute. Any declarations of interest submitted by members are surfaced at the next Council meeting to ensure that members continue to be aligned with the interests of the Institute.

The Council may have members who continue to serve more than 10 consecutive years in their role. Council members are nominated by various parties such as government agencies (i.e. Monetary Authority of Singapore, Ministry of Education and Ministry of Manpower) as well as local financial associations (represented by CEOs of financial institutions).

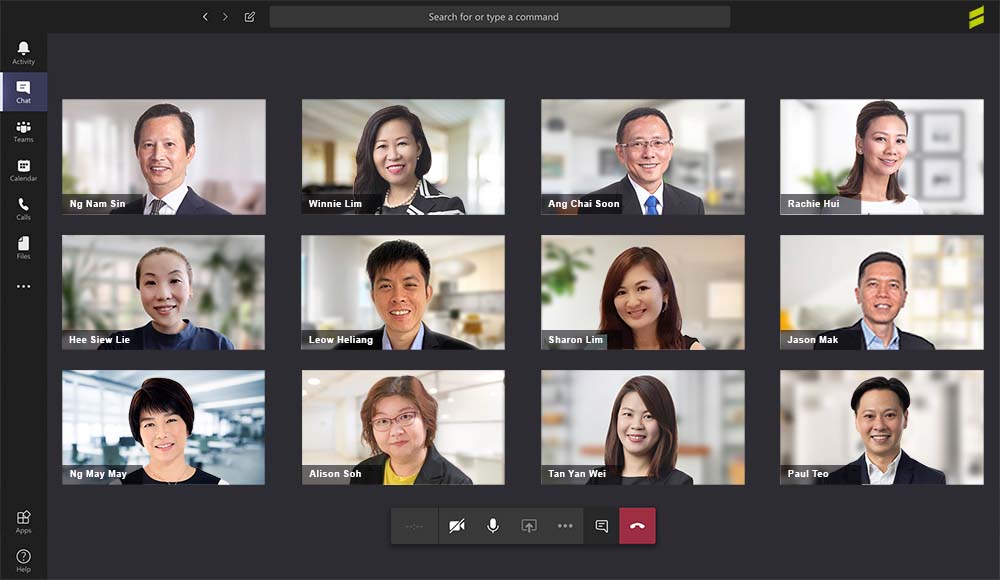

Council listing as at May 2021.

Managing Director,

Monetary Authority of Singapore

Chairman, The Association of Banks in Singapore (ABS); Deputy Chairman & CEO, United Overseas Bank Limited

Chairman, Sub-committee on Manpower Development, Singapore Foreign Exchange Market Committee (SFEMC);

Executive Officer,

Singapore Branch CEO, Mizuho Bank Ltd

CEO, Standard Chartered Bank (Singapore) Limited

Country CEO & CEO,

Maybank Singapore

Deputy Chief Executive (Industry), SkillsFuture Singapore

Chief Executive Officer,

AIA Singapore Pte Ltd

Chairman, Investment Management Association of Singapore (IMAS);

Co-Head Asia Pacific and Chief Executive Officer Singapore, Schroder Investment Management (Singapore) Ltd

CEO,

Singapore Exchange Limited (SGX)

Group Chief Executive Officer & Director, Oversea-Chinese Banking Corporation Limited

CEO & Director,

DBS Group

President, Life Insurance Association Singapore (LIA); Group Chief Executive Officer, Great Eastern Group

President, General Insurance Association (GIA) Singapore; CEO, MSIG Insurance (Singapore) Pte Ltd

Deputy Managing Director, Markets and Development, Monetary Authority of Singapore

Group Director, Enterprise Development Group, Workforce Singapore

ASEAN Head & Citi Country Officer, Singapore

Citibank N.A.

Assistant Secretary-General, National Trades Union Congress (NTUC); Co-Chairman, Financial Sector Tripartite Committee (FSTC); Chairman, Government Parliamentary Committee for Manpower

Chief Executive Officer,

NTUC Income Insurance Cooperative Limited

CEO,

Prudential Singapore

We thank the following members who have stepped down from the IBF Council:

Chong Yiun Lin

Tony Cripps

Jacqueline Loh

Patrick Teow

Samuel Tsien

Chairman (Appointed 15 April 2021)

Patrick Lee

CEO

Standard Chartered Bank (Singapore) Limited

Members

Brendan Carney

Chief Executive Officer

Citibank Singapore Limited

Chew Sutat

Senior Managing Director

Head of Global Sales and Origination

Singapore Exchange Limited

Paul Cobban

Managing Director

Chief Data & Transformation Officer, DBS Transformation Group

DBS Bank Ltd

Lawrence Goh

Managing Director

Group Technology & Operations

United Overseas Bank Limited

Robin Heng

Managing Director, Global Market Head

Bank of Singapore Limited

Kenneth Lai

Executive Vice President, Head Global Treasury

Global Treasury Division

Oversea-Chinese Banking Corporation Limited

Chelvin Loh

Director, Skills Development Group

SkillsFuture Singapore

Melvyn Low

Executive Vice President, Head of Global Transaction Banking

Oversea-Chinese Banking Corporation Limited

Nishit Majmudar

Chief Executive Officer

Aviva Ltd

Eleanor Seet

President & Head of Asia, ex-Japan

Nikko Asset Management Asia Limited

Gillian Woo

Director, Creative & Professional Services Division

Workforce Singapore

Andrew Yeo

Chief Executive Officer

NTUC Income

Loretta Yuen

Executive Vice President, General Counsel and Head of Group Legal & Regulatory Compliance

Oversea-Chinese Banking Corporation Limited

Sylvia Choo

Director (Union)

National Trades Union Congress

Executive Secretary

Singapore Industrial & Services Employees’ Union (SISEU)

Ng Nam Sin

Chief Executive Officer

The Institute of Banking & Finance (IBF)

The IBF Standards Committee comprises senior leaders from key sub-sectors of the financial services industry, government agencies and the union. The Committee provides guidance and supports initiatives to develop professional competencies through the adoption of the Skills Framework for Financial Services, certification and continuing professional development.

We thank the following members who stepped down from the Standards Committee:

Samuel Tsien (Chairperson)

Group Chief Executive Officer and Director (retired in April 2021)

Oversea-Chinese Banking Corporation Limited

Lawrence Lua

Managing Director

Senior Advisor, DBS Private Bank

DBS Bank Ltd

Eddie Tan

Managing Director, Regional Treasurer

Citi Treasury, Asia Pacific

Citibank N.A.

Sharon Chiew

Acting Director, Creative & Professional Services Division

Workforce Singapore

Loh Gek Khim

Director, Skills Development Division

SkillsFuture Singapore

The IBF Audit Committee oversees the Institute’s financial reporting process, risk management, internal control systems and processes and audit function.

Chairman

Guan Yeow Kwang

Chairman, Sub-committee on Manpower Development,

Singapore Foreign Exchange Market Committee (SFEMC);

Executive Officer,

Singapore Branch CEO,

Mizuho Bank Ltd

Members

John Lee

Country CEO & CEO,

Maybank Singapore

Michael Fung

Deputy Chief Executive (Industry)

SkillsFuture Singapore

Wong Sze Keed

CEO

AIA Singapore

We thank the following member who stepped down from the IBF Audit Committee:

Chong Yiun Lin

Director (Polytechnic & ITE Policy)

Higher Education Policy Division

Ministry of Education

Principal Officer

Mr Ng Nam Sin

Chief Executive Officer

Auditors

Deloitte & Touche LLP

Public Accountants and Chartered Accountants

Secretaries to the Council

Mr David Chong Keen Loon

Ms Leong Yoke Yeng

Solicitors

Shook Lin & Bok LLP

Advocates & Solicitors