What is a Digital-Only Bank?

- A digital-only bank delivers financial products and services purely through mobile applications or web channels without the presence of physical branches.

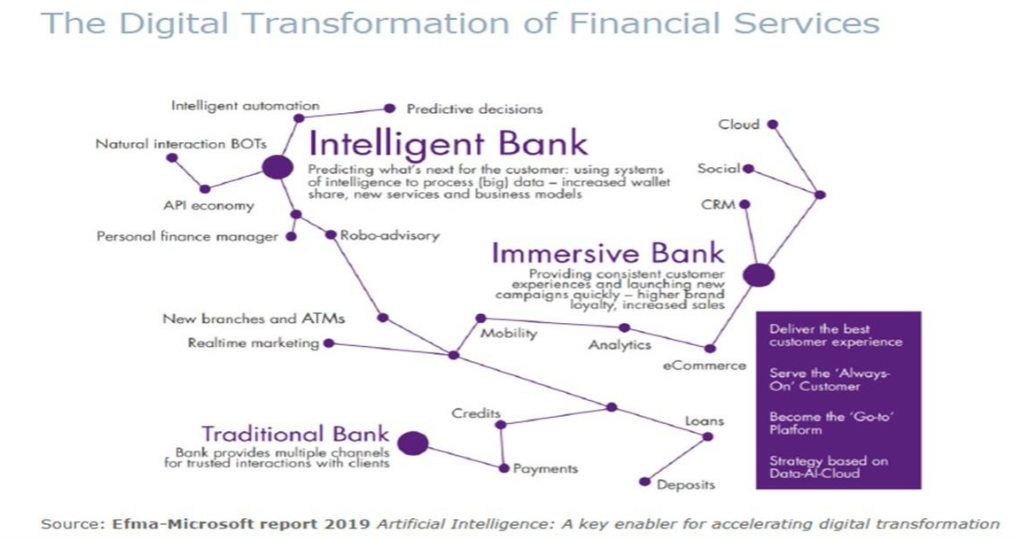

- While all banks rely on various technologies such as cloud, data science, artificial intelligence (AI) and machine learning, digital-only banks are far more extensive in deploying these technologies to (i) automate end-to-end banking processes, and (ii) have their clients self-serve for almost all their products and service offerings.

- Experience in other countries suggest that digital-only banks’ growth are mainly attributed to (i) increased internet capacity such as 4G mobile network and popularization of smartphone, (ii) changing profile of customers who are increasing digital savvy, (iii) lower operating cost, and (iv) success in reaching out to customers who are previously unserved or underserved by the traditional banks.

- Digital-only banks can be both partners and competitors of traditional banks.

Digital-only banks in Singapore

- A relatively new concept in Singapore, Monetary Authority of Singapore (MAS) announced the issuance of up to five digital banks licenses (two digital full bank and three digital wholesale bank) on 28 June 2019. The digital banks are expected to start operating in mid-2021.

- A digital full bank serves both retail and non-retail customers while a digital wholesale bank only caters to the SMEs and other non-retail customers.

- Regulated by MAS, digital-only banks must be incorporated in Singapore and comply with all banking regulations.

- As digital full banks are permitted to collect deposits from the public, MAS is mindful of the need to build public confidence in digital banks and ensure a safe financial system.

- MAS has taken a three-phase approach with various requirements such as deposit caps and permissible activities. The three phases are (i) Restricted Digital Full Bank (Entry), (ii) Restricted Digital Full Bank (Progression) and (iii) Digital Full Bank.

.jpg?sfvrsn=366f6519_1)

Entry requirements for Digital Full Banks in Singapore (Source: MAS website)

Value Proposition

Typically, the winning value proposition offered by digital banks in most countries rest on the following:

- Convenience – customers can conduct their transactions digitally, any time anywhere.

- Lower Cost – lower operating cost allows cost savings to be passed on to the customers in terms of lower fees or higher deposit interest.

- Superior Customer Experience – focus on superior customer experience by specializing in delivering a product and/or service (end-to-end) digitally.

- Partnership – Many digital banks have partnered with two or more firms allowing their customers multiple touchpoints to tap and leverage on each other's offerings. For example, SC Digital in Hong Kong which is jointly owned by Standard Chartered Bank (Bank), PCCW (Telco), HKT (Telco) and Ctrip (Travel Service Provider) integrate digital banking services into their partners’ customer base and distribute both financial and non-financial services through a single platform. This concept reflects active participation in industry/banking ecosystem.

| Digital banks have forged partnerships with firms to allow their customers to tap and leverage on each other's product/service offerings |

For digital banks in Singapore, MAS requires applicants to also submit their value proposition for consideration in the areas of:

- Financial Inclusion – Singapore’s digital banks must have a clear plan on how to address the unmet banking needs of the unserved or underserved segment of Singapore such as (i) removing minimum deposit requirements, or (ii) adopting a different credit risk assessment.

- Sustained Growth – Cement Singapore’s position as a global financial centre by (i) introducing innovative business models, products, services and technology, (ii) enhancing growth sectors such as sustainable financing, SMEs and start-up financing, and wealth management.

Key Developments

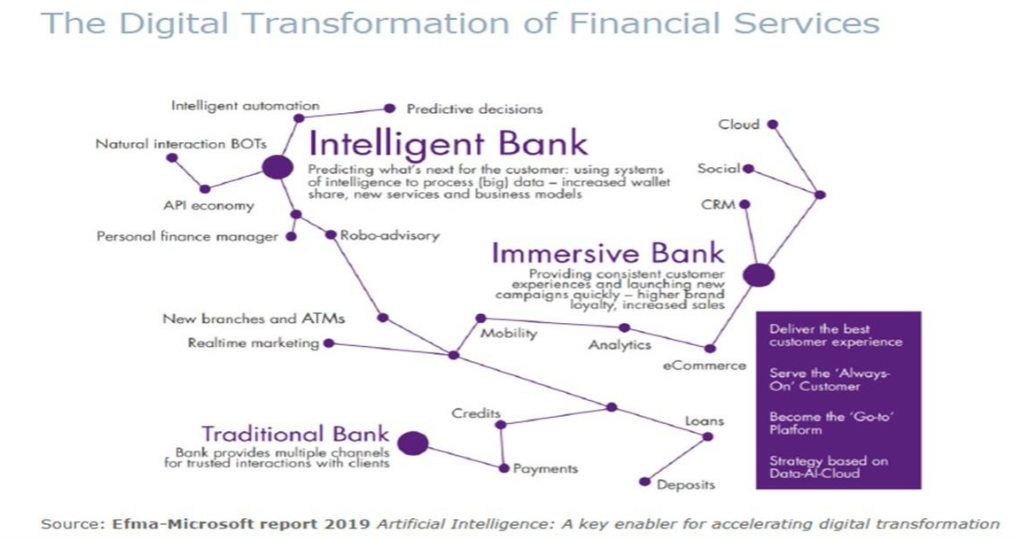

Digital banking is in a nascent stage which has a lot of growth potential but banking practices and products are not harmonized across different digital banks. Rapid changes in technology, and consumer preferences will drive developments in digital banking.

1. Technology arms race – Digital banks’ survival and growth rely heavily on emerging technologies such as blockchain, artificial intelligence, machine learning (eg. chatbot), cloud-based applications, facial recognition, and even biometrics. These technologies are crucial to help digital banks widen their reach where provision of services are not constrained by timing or geography.

2. Design for customer – Design every digital process within the banking operations, taking into account the end-to-end view of customer journey in order to improve customer experience as a whole.

3. No longer going solo – Collaborations are crucial in the development of digital-only banks as they can contribute to:

- Access to significant number of customers with reasonable cost, preferably with partners having intimate knowledge on the spending behaviors of the customers.

- Multiple touchpoints to distribute both financial and non-financial products and services to customers.

- Technologies and data analytics expertise to improve customers’ experience.

- Build consumers’ trust and confidence with a recognizable corporate anchoring the digital bank.

4. Going cashless

- Contribute to seamless payment systems so as to improve efficiency

- Improve transparency as digital footprint of the cashless transactions will strengthen anti-money laundering and counter-terrorist financing regimes.

Changes in technology and consumer preferences are likely to drive many customers to digital banks |  |

The Future of Digital-Only Banks in Singapore

- Digital-only banks will have to develop a niche market segment and they do not cannibalize established banks’ market share.

- Digital-only banks seek to offer seamless customer experience in payments, peer-to-peer lending, investments, and remittance.

- Similar to Hong Kong, the growth of digital-only banks depends largely on collaborating with non-banks for mutual benefits: lowering customers' acquisition cost with expanded base and better understanding of customers' behavior with quality data.

Did you know?Neo banks or Challenger banksA completely digital bank that operates exclusively on mobile applications and web channels. The term "neo bank" became prominent in 2017 to describe FinTechs challenging traditional banks.

Early examples of Neo banks are WeBank in China, Chime in United States, and Revolut in the United Kingdom.

|  |

Key Challenges

1. Risk management, compliance and capital allocation

- With non-financial institutions as partners, digital-only banks are unfamiliar with the risk exposure and the level of regulatory scrutiny expected of a bank.

- They would have to demonstrate competency in risk management and compliance especially in preventing financial crimes (eg. money laundering, terrorist financing, sanction breaches) and conforming to data protection standards.

- Digital-only banks might also be less familiar with capital allocation that facilitates the assessment of relative performance across all their business lines.

- The ability to run digital-only banks safely and securely is crucial in gaining customer trust in order to grow.

2. Customer experience and cyber security arising from emerging technologies

- Likewise for traditional banks, digital-only banks should consistently upgrade their technology capabilities while considering trade-offs between efficiency and customer experience.

- Monitor vulnerabilities more closely in areas of cyber security and data protection to manage common security breaches such as (i) common passwords, (ii) phishing, (iii) malware or keylogging, and (iv) hacking.

- Continuous engagement with customers and technology providers to drive greater awareness on cyber security risks and practise protection measures.

- Keep pace with new technology innovation to stay relevant.

3. Unique market landscape in Singapore

- A study conducted in late 2019 by Visa Customer Survey showed that while 65% of Singaporeans are willing to bank with a digital bank, it also showed that 84% are interested to use digital services offered by an existing bank.

- Singaporeans are more likely to use selected services such as money transfers and payments with a small proportion of their assets, instead of capitalizing on the entire suite of banking products.

- Due to lack of long track record, there may be concerns on quality of their service delivery and even their ability to stay afloat in times of major crisis.

- The low proportion of unbanked residents as well as incumbent banks’ rich digital product and service offerings makes it very challenging for digital banks to capture sufficient market share.

- Given the size of Singapore's market, digital banks need to position themselves as the regional bank of choice. Digital banks need to have a clear view of profitability and operating at an optimum cost-income ratio, supported by the right mix of talent to grow.

Skillsets in Demand for Digital Banking

What are the broad skillsets required for digital banking?

- Technology skills such as data science, artificial intelligence, cloud application, User Experience (UX) and User Interface (UI) are highly sought after;

- Process Management – Agile

- Business Process – digital marketing, business process development (such as credit scoring), banking product development, risk management process.

Skillsets in demand by Digital-Only banks include a blend of technology related skills and core business/banking competencies

TECHNOLOGY & DATA Data Science Artificial Intelligence (AI) Cloud Application Machine Learning | HUMAN CENTERED DESIGN User Experience (UX) User Interface (UI) |  |

PROCESS MANAGEMENT Agile Scrum Lean | BUSINESS ACUMEN Digital Marketing Banking Product Knowledge Risk Management |

Banking Glossary

Please refer to commonly used banking terms and acronyms here.

Overview

Overview

.jpg?sfvrsn=366f6519_1)