What is Private Banking?

- Private banking offers personalized financial services and products to the high-net-worth inpidual (HNWI). The focus of private banking is on (i) client relationship management, and (ii) personalized services.

- HNWI is a person or family with investable/liquid assets in excess of a certain figure which may differ from country to country. In Singapore, private banking generally starts with $5 million.

- Products and services offering includes a wide range of wealth management services using a single point of contact, usually the relationship manager (RM).

- Private banking monitors its Asset-Under-Management (AUM) closely. AUM refers to the total amount of assets in dollars managed by private banking for their clients.

- Increasingly, private banking is starting to offer financial services to cater to the personal wealth needs of the banks’ corporate banking clients.

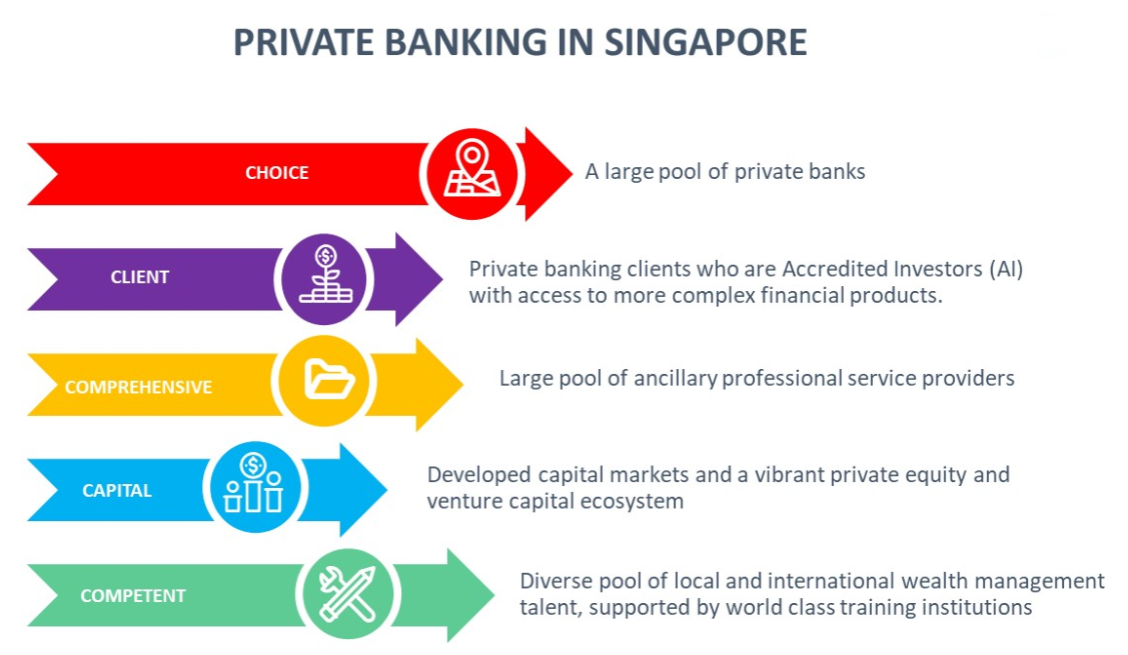

Private Banking in Singapore

Singapore is one of the key private banking hubs in the world, mainly serving the Asian HNWIs. Generally, the top source of funds for Singapore private banking businesses are China, India, Indonesia and Malaysia.

The other major wealth hubs in the world are Hong Kong and Switzerland.

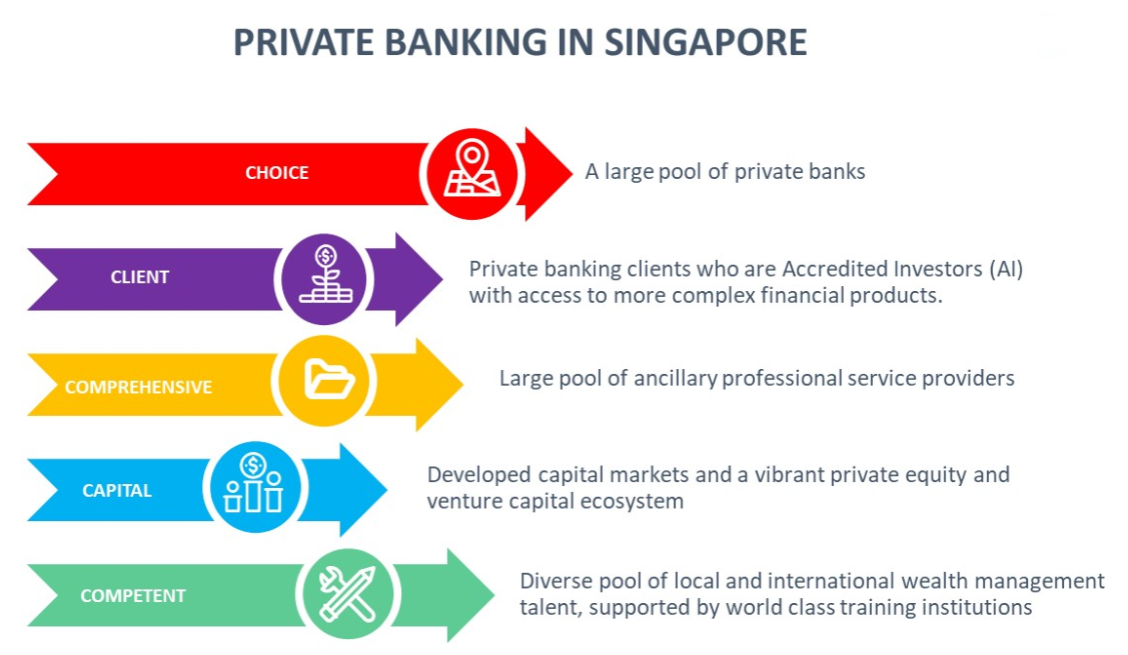

As a leading private banking hub in the world, Singapore has some unique characteristics that differentiates it from its competitors, such as:

- Comprehensive pool of private banks;

- perse pool of local and international wealth management talent, supported by world class training institutions;

- Developed capital markets as well as a vibrant private equity and venture capital eco-system;

- Large pool of ancillary professional service providers such as tax specialists, legal advisors, consultants and technology platform providers;

- Generally, private banking clients in Singapore are deemed as Accredited Investors (AI) who have access to more complex financial products.

Some examples of private banks operating in Singapore are:

- Bank of Singapore

- BNP Paribas

- Citibank

- Credit Suisse

- DBS

- HSBC

- Julius Baer

- Morgan Stanley Private Wealth

- UBS

- UOB

| Did you know?Accredited Investor (AI)

High Net Worth Clients in Private Banking typically qualify as Accredited Investors (AI). Accredited Investors are deemed to be well-informed on investment-related issues, and thus may require less consumer protection.

This is part of the regulatory landscape which allows Accredited Investors with appetite for higher risk to access more complex financial products.

|

|---|

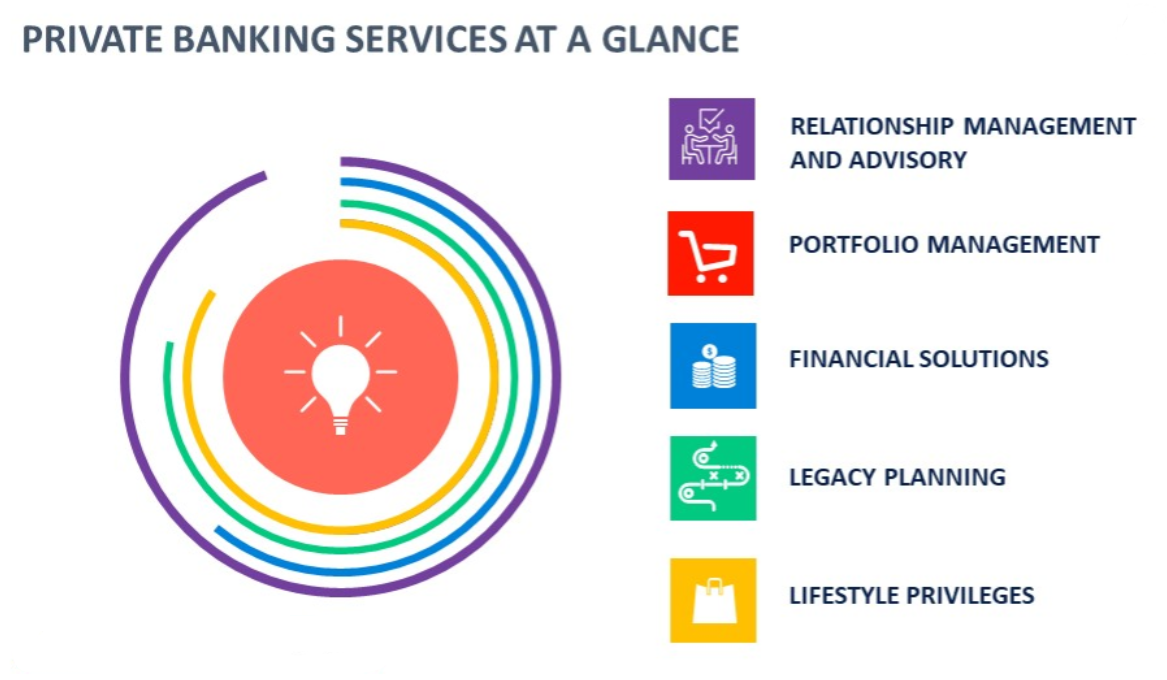

How Private Banking Services its Clients

Beyond products and services, private banking offers tailored services to address the needs and requirements of private banking clients.

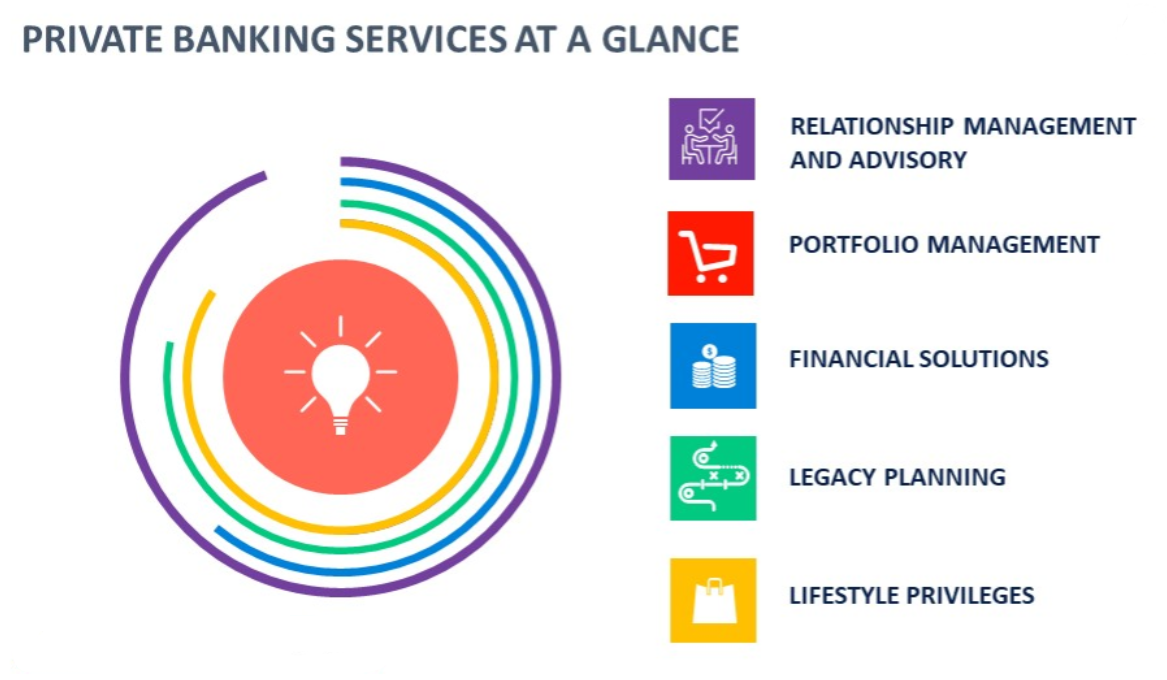

Some of the customised services are:

- Relationship Management and Advisory such as discretionary portfolio management where the relationship manager representing the client utilize expertise from investment professionals in different asset classes to create bespoke portfolios that that matches their clients’ investment objectives, risk profile, duration and expectation using tailored asset-allocation strategies.

- Portfolio management in terms of asset allocation across various asset classes such as traditional investment products (equity, fixed income, mutual funds, money market, real estate, derivative) and alternative investment (crypto products, art work) by reviewing performance of investment portfolios and realign the weightings of portfolio.

- Financial solutions such as wealth management services or credit solutions such as investment financing, real estate financing or bespoke financing solutions like purchasing a yacht.

- Legacy planning including solutions such as Universal Life, wealth planning, estate consolidation, structuring of wills and trusts so as to protect the family in order to ensure continuity.

- Lifestyle privileges extended to private banking clients that include lifestyle experiences such as concierge services in airports, hospitals, premium events, etc.

Private banking offers bespoke advisory services and financial planning solutions that cater to the needs of their clients

Value Proposition

As a one-stop “shop”, private banking is able to provide bespoke financial solutions for the clients such as offering tailored solutions that aims to match clients’ expectations and requirements precisely.

Private banking is able to provide their clients with broader access to more complex products such as discretionary portfolio management or bespoke credit solutions.

It is also able to provide platforms for their clients and their next generation to network and interact for business opportunities. Private banking also organizes premium and exclusive events for their clients to network and holds workshops for the younger generation clients on topics ranging from succession to financial literacy.

Did you know?The oldest Swiss private bank in Landolt & Cie established in 1780. Singapore was founded in 1819.

Switzerland's self-imposed foreign policy of neutrality dating before World War I and its strong tradition of banking secrecy contributed to being the most established private banking hub in the world.

|

|

|---|

Current and Emerging Trends

Private banking constantly enhances clients' experience holistically at various touchpoints which includes:

- interaction with relationship manager;

- experiences with services in bank branches, and;

- experiences in using private banking’s digitalized services.

Private banking products and services have expanded to include family offices and shifting its focus on advisory services and legacy planning. This calls for strengthening of relationship with its clients, building trust and setting long-term business. This may also result in increased attention on the services of Family Offices, External Asset Management (EAM) and Trust Administration.

Private banking will continue to invest in technologies including expanding web and mobile channels to provide real-time service to engage private banking clients.

.jpg?sfvrsn=4aeedd30_1)

| Code of Conduct

To further strengthen competency and market conduct standards of the PB sector in Singapore, a Code of Conduct was developed by the Private Banking Advisory Group (PBAG) together with the Monetary Authority of Singapore.

|

|---|

Key Challenges

Consumer preference among private banking clients has evolved where confidence and loyalty in banks are lower among the younger clients compared to the more senior clients.

Private banking faces escalating cost as overall remuneration for relationship managers remains high. Private banking is also expected to invest in technology to automate transactional services and to cater to younger, more tech-savvy clients.

Regulatory changes such as data protection, cyber security, customer due-diligence (CDD) for compliance will impact the private banking’s internal processes.

For private banking to stay ahead of the challenges, it needs to:

- Continuously upskill and reskill its staff to meet clients' changing needs and expectations.

- Work with other firms and divisions to provide specialised products and services such as external asset manager (EAM) or independent asset manager (IAM).

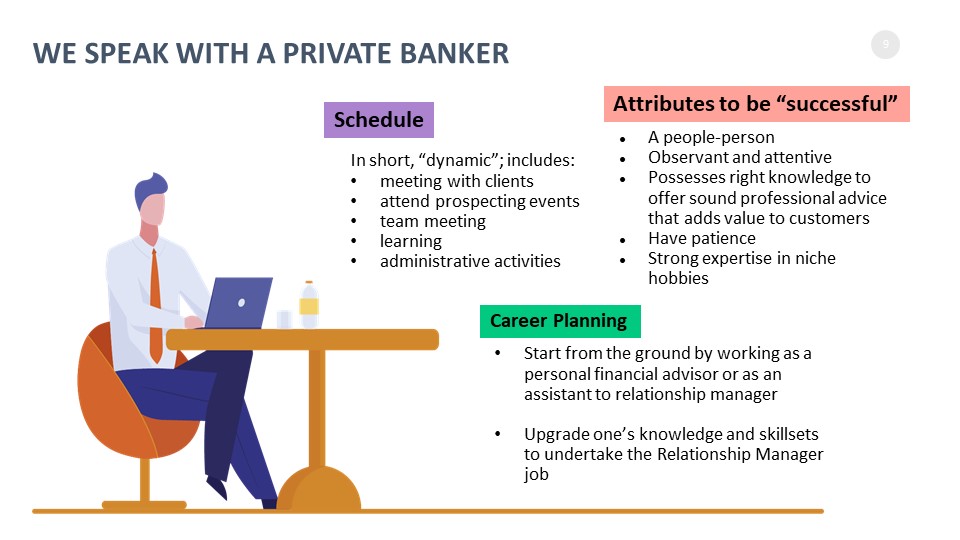

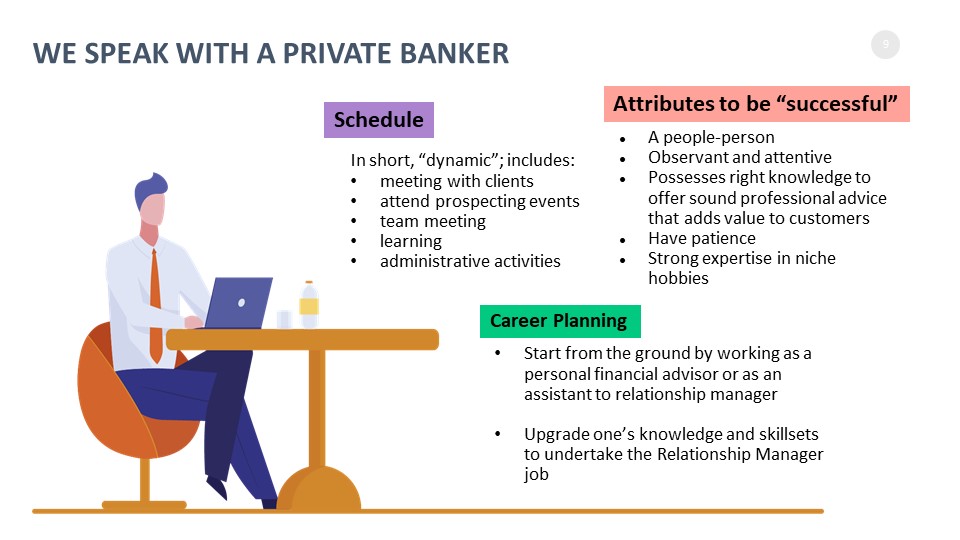

A Career in Private Banking

To better understand the possible career pathways in Private Banking, you may refer to the Skills Framework for Financial Services.

The Skills Framework (SFw) is a SkillsFuture initiative developed for the Singapore workforce to promote skills mastery and lifelong learning, and is an integral component of the Financial Services Industry Transformation Plan.

Jointly developed by SkillsFuture Singapore (SSG), Workforce Singapore (WSG), Monetary Authority of Singapore (MAS), and the Institute of Banking and Finance (IBF), together with industry associations, training providers, organisations and unions, the Skills Framework for Financial Services provides useful information on:

- Sector information;

- Career pathways;

- Occupations and job roles;

- Existing and emerging skills; and

- Training programmes for skills upgrading and mastery.

Banking Glossary

Please refer to commonly used banking terms and acronyms here.

Overview

Overview

.jpg?sfvrsn=4aeedd30_1)