What is Environmental, Social and Governance (ESG)?

Environmental, social, and (corporate) governance - typically referred to by its acronym ESG - refers to a firm's collective conscientiousness for and behaviour in social and environmental matters.

A firm's ESG rating could be regarded as a corporate social credit score measuring the firm's sustainability and societal impact. It aims at integrating non-financial considerations in the assessment of a firm's value, arguably, to provide investors with a better risk-adjusted return on investment.

Environmental

The environmental component evaluates the firm's direct and indirect impact on the environment. Environmental criteria may include assessing the firm's energy use, waste, pollution, natural resource conservation, and treatment of animals. The criteria can evaluate any environmental risks the firm may face and how the firm is managing those risks; for instance, issues relating to the disposal of hazardous waste, or compliance with environmental regulations.

Social

Social criteria cover a broad range of possible issues, mostly related to social relationships. For example, the majority of socially responsible investors regard the firm's relationship with its employees as one of the key relationships. Other considerations include the alignment of the firm's stakeholders, such as its suppliers, or support of the local community.

Governance

Governance evaluates the rights and responsibilities of the management of a firm (i.e., its board, shareholders, and the various stakeholders in that firm). Considerations may include on firm's tax strategy, executive remuneration, donations and political lobbying, corruption and bribery, and board persity and structure.

Importance of ESG

According to Bloomberg Intelligence, global ESG assets are on track to exceed USD 53 trillion by 2025, which would represent more than a third of the USD 140.5 trillion in projected total assets under management.

The growth of, and momentum behind, sustainability-related products is propelling a paradigm shift in the asset management industry worldwide whereby asset managers are now capitalising on sustainability-related opportunities and developing new sustainability-related products targeting both retail and institutional investors at an unprecedented pace.

In addition, the COVID-19 pandemic has accelerated investor demand for sustainable investments. It is estimated that USD 120 billion was invested into sustainable investments in 2021. This doubles the USD 51.1 billion records of ESG funds in 2020 and sets a new consecutive annual record. Overall, ESG funds now account for 10% of worldwide fund assets.

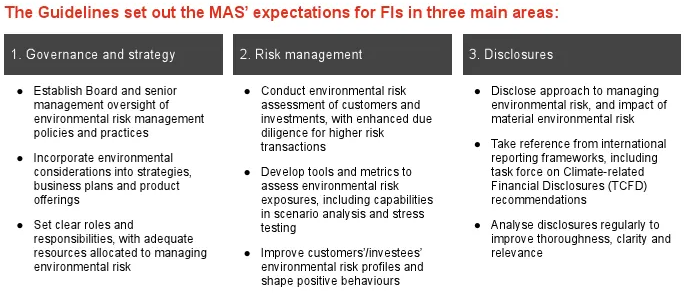

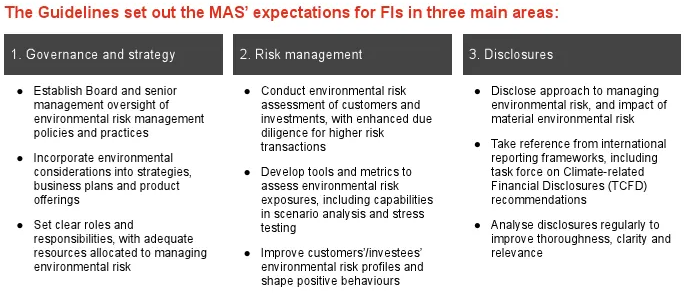

MAS Guidelines on Environmental Risk Management

On 8 December 2020, the Monetary Authority of Singapore (MAS) published the finalised Guidelines on Environmental Risk Management ("Guidelines") for banks, insurers and asset managers, following consultation papers issued earlier in the year.

The guidelines aim to enhance the resilience of financial institutions ("FIs") to environmental risk and strengthen the role of Singapore's financial sector in supporting the transition to an environmentally sustainable economy.

(Source: Environmental Risk Management for Financial Institutions, PwC)

What are the Key Environmental Risks?

The Task Force on Climate-related Financial Disclosure ("TCFD") framework, a widely adopted framework by regulators, corporations and financial institutions as a method for identifying, assessing, and disclosing climate-related and environmental risks, defines and classifies climate-related and environmental risks into two major risk categories with six sub-categories (as shown in following diagram).

(Source: Environmental Risk Management for Financial Institutions, PwC)

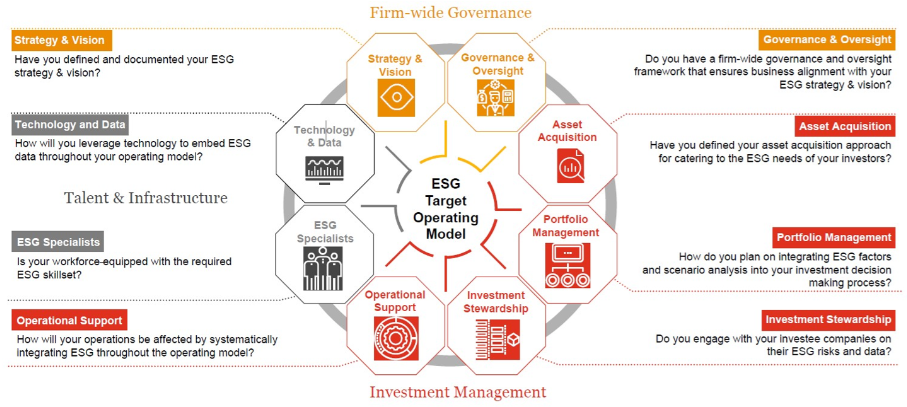

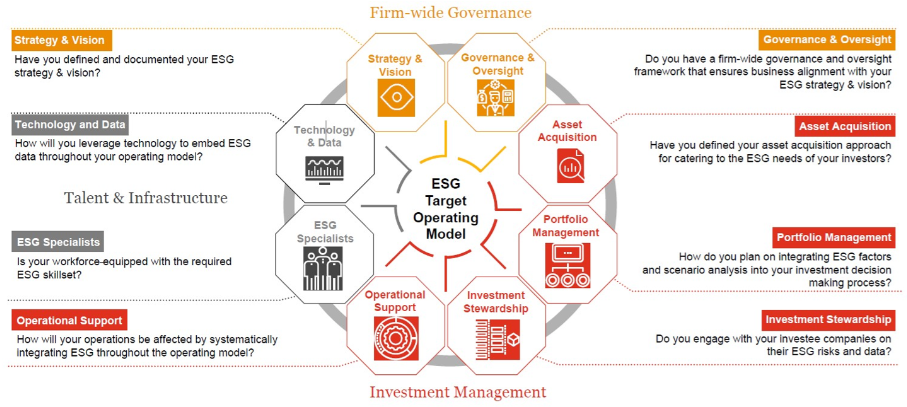

The management of environmental risks requires a holistic approach by the financial institution from the alignment of its strategy and vision, governance and oversight, integration of environmental risk management in its business processes (e.g. credit assessment, portfolio management, underwriting), risk management, and resource planning.

The following diagram highlights the different areas an asset management company should consider:

Governance and Strategy

MAS' regulations require banks, insurers and asset managers, to put in place a risk management framework to identify, address and monitor the risks, which is appropriate to the nature, scale and complexity of the assets. These risks include environmental risk.

Effective governance and strategy should ensure that there is a sound understanding, oversight, and accountability for environmental risks throughout the financial institution, including at the board and senior management levels. As the board of directors is the highest governing body, the full board or a committee delegated by the board are expected to be accountable for environmental issues in relation to the long-term resilience of the firm.

The board is responsible for providing the direction in setting the financial institution's risk appetite, strategies, and business plans. The senior management is responsible in ensuring the development and implementation of the framework and policies and providing guidance to the business functions with respect to the defined risk appetite.

Risk Management

Financial institutions should identify material environmental risks and assess the potential impact on their business. For example, banks must consider the higher risk - and are, therefore, discouraged - from providing loans to sectors with material environmental risk; insurers need to determine the impacts on their underwriting methodology. For sectors with higher environmental risk, financial institutons must develop sector-specific policies to articulate the firm's expectations towards an existing or prospective customer.

Additionally, financial institutions should actively manage and monitor their environmental risk exposures at customer and portfolio levels. At the customer level, financial institutions should, on an ongoing basis, monitor for adverse environment-related activity, or potential non-compliance with their policies.

Research and Portfolio Construction

Portfolio investments may be exposed to a wide range of environmental risks, which can be linked to both transition and physical risks on an inpidual asset and/or portfolio level. When conducting environmental risk assessment, financial institutions shall also make reference to international standards and frameworks such as Global Reporting Initiative, CDP (formerly the Carbon Disclosure Project), and the Sustainable Accounting Standards Board.

To be effective, financial institutions must understand the ways in which environmental issues, among other issues, affect their long-term return.

- Both physical and transition risk considerations should be embedded in the research and portfolio construction if assessed to be material.

- Measurements and management of environmental risk factors should be included on an aggregate basis as part of portfolio construction.

- Risk criteria should be adopted to identify sectors with higher environmental risk with sector-specific guidance developed to support the investment teams understanding of environmental issues.

- Publicly available research can be used if cost is an issue for smaller financial institutions.

Coal power plants face transition risk from more stringent laws and carbon credits

(Photo credits: Wim van 't Einde, Unsplash)

Portfolio Risk Management

Financial institutions should put in place appropriate processes and systems to monitor, assess and manage the potential and actual impact of environmental risk on inpidual investments and portfolios on an ongoing basis, where material.

- Processes and systems should be in place for the ongoing monitoring of material environmental risks at both a security and portfolio level.

- Scenario analysis should be developed to assess the impact to the portfolio for both short- and long-term environmental scenarios.

- Robust documentation should be in place outlining assumptions and actions taken to address the risks.

- The firm's staff should be provided with adequate capabilities and capacity to assess and manage environmental risk.

Scenarios analysis may evaluate the impact of natural disasters on assets, companies and economies

(Photo credits: Jet Reyes, Pexels)

Stewardship

MAS expects financial institutions to exercise sound stewardship to help shape the corporate behaviour of customer and investee companies positively through engagement, proxy voting and sector collaboration.

Establishing a stewardship and voting policy clearly sets out the firm's priorities and principles for engagement with portfolio companies and on public policy. Principles that can be included are such as advocating for sustainable finance to be a standard practice, promoting greater integration of environmental risks by portfolio companies, and having investors in equities vote at shareholder meetings to promote good corporate governance standards.

The following are examples of topics for engagement with customer / investee companies:

- Raising of environmental issues with customer / investee companies to increase their awareness of environmental risks and opportunities.

- Influencing the behaviour of customer / investee companies to better manage and mitigate environmental risk.

- Gathering information to supplement existing environmental risk disclosures from customer / investee companies.

- Encouraging customer / investee companies to provide relevant and timely environmental risk data and/or clearer disclosures to improve data availability and consistency.

Disclosure

Financial institutions should disclose their approach to managing environmental risk in a manner that is clear and meaningful to their stakeholders, including existing and potential customers. Financial institutions are encouraged to disclose the potential impact of material environmental risk to customers, including quantitative metrics such as exposures to sectors with higher environmental risk. An asset manager's disclosure may be consolidated at the group or head office level.

The TCFD recommendations (Recommendations of the Task Force on Climate-related Financial Disclosures, 2017) provide a useful framework for the disclosure of climate-related risks as follows:

- Governance, including the board's oversight and management's role in assessing and managing climate-related risks and opportunities.

- Strategy, in relation to the actual and potential impact of climate-related risks and opportunities on the financial institution's business, relevant products and investment strategies, where such information is material.

- Risk management: How the financial institution identifies, assesses and manages climate-related risks.

- Metrics and targets to assess and manage relevant climate-related risks and opportunities where such information is material.

Overview

Overview