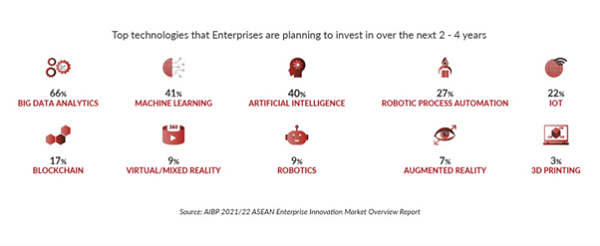

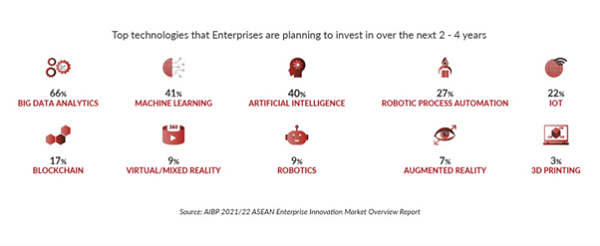

According to AIBP'S ASEAN Enterprise Innovation Survey, respondents from ASEAN's banking and financial services industry listed big data analytics (66%), machine learning (41%), artificial intelligence (40%), and robotic process automation (27%), as the top technologies that they are planning to invest in over the next two to four years.

"AI is used to complement human interaction, never as a substitute... it is about leveraging the human touch and technology touch."

"AI can help improve processes, operations, and facilitate with decision making efficiently."

These statements are top of the mind for many stakeholders and most of them are working to explore ways that AI and Machine Learning (ML) can help them deliver their objectives. Since AI is very broad, we will focus on exploring the ways in which ML are applied currently in ASEAN banks.

ML is a type of AI that enables self-learning from data. By using statistical models and algorithms to analyse and draw inferences from patterns in data, ML is able to apply learning without the need for human intervention. In the banking and financial services industry, there are many different applications of ML across various functions.

1. Creating personalised experience through risk profiles

Big data capabilities can track and store as much information about the bank's customers as needed, providing the most precise and personalised customer experience. Optimising the customer footprint allows banks to leverage analytical capabilities of ML to detect even the slightest and most subtle tendencies in customer behaviour, which contributes towards a more personalised experience for each inpidual customer.

By creating a personalised insurance profile for their customers, insurers in Malaysia are introducing algorithms to apply risk scoring for each customer based on their historical and personal data. For example, those with better driving records and more driving experience will pay lower premiums. Hence, insurance agents are not required to manually evaluate each customer's suitability to a particular premium, thereby increasing efficiency and productivity.

Financial institutions can optimised operational efficiency through automation of perse areas in BFSI operations. Furthermore, successfully resolving pain points will be critical for financial institutions to deliver a superior experience and better outcomes.

2. Increasing efficiencies in customer experience through chatbots

Chatbots designed and implemented by financial institutions are programmed with both ML and Natural Language Processing (NLP). Building and programming bots can be time consuming initially, but in the long run, can help to save a lot of time and money, and can improve efficiency by providing fast-paced communication, round-the-clock support and personalised experience for customers through the instant access to customer's data.

The success in improved customer service is evident in CIMB Bank's launch of its chat-based virtual assistant, Enhanced Virtual Assistant (EVA), which has managed to generate approximately 130,000 downloads and 300,000 transactions in less than a year. Since the introduction of EVA, the total number of active mobile banking users has increased by 6.3%, and the mobile banking active user rate improved to 41% compared to 38% prior to the launch of the project.

By prioritising conversational user interface (UI), CIMB is able to construct a chatbot that is highly valued by customers.

3. Enhancing security when transacting with image recognition

Image recognition is a technology capable of identifying objects, places, people and actions in images. It employs ML algorithms which capture, find, store and analyse features in order to verify them with images in a pre-existing database.

Image recognition can be used either for enhancing customer experience or security. An example of the former is ID scanning in banks or credit card scanning functionality in payment applications. In these mobile banking applications, the security feature entails either ID or biometric authentication

4. Mitigating fraudulent transactions by analysing real-time data

Taking into consideration hundreds of factors including device used, customer's location and transaction history, AI and ML algorithms are capable of processing large amounts of data in real time.

These algorithms function significantly quicker than humans when detecting new and emerging security threats, be it a suspicious transaction that may require additional authentication, hackers stealing credit card information and attempting to make a purchase, or a spike in traffic from an unusual source. McKinsey estimated that losses from such frauds could amount to US$44 billion by 2025.

Moreover, since AI and ML algorithms can analyse much larger data points, connections between fraud patterns and entities, the emergence of false positives can be drastically reduced. This means fewer customers will be falsely alarmed for fraudulent concerns and fewer will be falsely rejected for fraudulent transactions, which in turn minimises the labour and time costs associated with allocating staff to review flagged transactions.

Many banks in ASEAN have been successful in fraud detection and an example would be UOB in Singapore. UOB utilises an anti-financial malware system based on ML that tracks the device its banking services were accessed from and the behavioural biometrics of the user in real time where any deviation from the transaction patterns of customer accounts would indicate a potential scammer, and thus alert the banks. These have proven effective with UOB being able to recover $6.69 million in a business and impersonation scam in 2020.

Therefore, through the application of AI and machine learning, financial institutions can analyse a wealth of information from several different data sources and channels in real time, allowing them to make critical security-related decisions almost instantaneously to prevent fraud, without compromising on the customer experience.

Whilst these have been effective in most instances, moving forward, it is imperative that financial institutions collaborate as they harness and enhance their technology to keep up with the changing tactics of scammers, as part of the efforts in stopping fraudulent banking activities.

The road ahead

To conclude, it is clear that advances in ML have been instrumental in enhancing security and increasing efficiency in various applications across the banking and financial services industry in ASEAN.

The road ahead is exciting with many more opportunities and possibilities for financial institutions to harness the power of AI and ML.

This article was contributed by AIBP

Overview

Overview