Q1. Are there guides and FAQs on the submission for funding support in Training Partners Gateway

(TPGateway)?

For information on the submission for funding support in Training Partners Gateway (TPGateway), you may refer to the self-help guides at https://www.tpgateway.gov.sg/who-we-are/self-help-guides and the FAQs at https://www.tpgateway.gov.sg/faq.

Q2. What are the trainees’ details that we would need to collect for the funding claims submission in

TPGateway?

Self-sponsored Trainee

• Full name (as per NRIC)

• Date of Birth (Actual details in DDMMYYYY)

• NRIC

• ID Type (NRIC, FIN, Others)

• Email address

• Contact number with country code[1]

Company-sponsored Trainee

• Full name (as per NRIC)

• Date of Birth (Actual details in DDMMYYYY)

• NRIC

• ID Type (NRIC, FIN, Others)

• Email address

• Contact number with country code1

• Financial Institution’s / Singapore FinTech Association certified FinTech firm’s name & UEN

• Company course representative name, email address and contact number with country code[1]

[1] Country code is required for enrolment bulk submission

Q3. Are sponsoring companies required to furnish their staff’s personal details such as NRIC to the

Training Provider?

Yes, NRIC records and other personal data of the eligible trainee are required to be furnished to the training provider for application of the course fee subsidies. You may refer to the IBF Circular on the "Advisory Guidelines on the Personal Data Protection

Act (PDPA) for NRIC and other National Identification Numbers" for more information.

Q4. Is it mandatory to indicate email address and mobile number for grant submissions in Training

Partners Gateway (TPGateway)?

For trainee enrolment, both email address and phone number are mandatory fields to be indicated for trainee enrolment. For trainee attendance, either email address or mobile number is mandatory. For mobile numbers, please note that system only accepts

Singapore-registered number. The mobile number must be 8 digits and start with the digit 8 or 9.

Q5. Why do I need to indicate ‘Date of Birth’ and ‘Contact Number’ when submitting trainee enrolment

in TPGateway?

Please note that the 'Date of Birth' field is for the system to determine the trainee's eligibility for funding and the collection of 'Contact Number' is for audit notification purposes. For more information on IBF’s policy on Personal Data Protection,

please visit our privacy policy page https://www.ibf.org.sg/Pages/Privacy-Policy.aspx or email [email protected] for further enquiries.

Q6. Are Goods and Services Tax (GST) supported under the IBF-STS or FTS course fee subsidy?

With effect from 3 October 2022, the GST amount is no longer supported under IBF-STS or FTS.

Q7. I am a Financial Institution and have sponsored my staff for an IBF accredited course offered by an

external training provider. How do I submit claims in TPGateway?

Please note that Financial Institutions no longer need to submit claims for funding support for external courses that commence from 10 October 2022 as all external courses are offered on a nett fee model. Training providers will be submitting the claims

in TPGateway for the external courses attended by the trainees. Kindly refer to the table below for reference. Financial institutions will only need to use TPGateway if they have grants to submit for their own accredited in-house courses.

| External courses

|

| | Submission platform | Submission by |

| Courses commencing on or after 10 October 2022

*Courses should all be on nett fee model | TPGateway | Financial Training Provider (FTP)

|

| Internal courses by Financial Institutions |

| | Submission platform | Submission by |

| Courses commencing on or after 10 October 2022

| TPGateway | Financial Institution (FI) |

Q8. What is the trainee cap for IBF accredited courses?

The number of trainees for classroom and synchronous e-learning mode of training is capped at maximum 40 trainees per session.

Q9. What will happen if a trainee (a) drops out halfway through the course; or (b) does not pass the

assessment for the course?

Training providers are required to upload the trainee’s assessment and select “Fail” if the trainee does not pass the assessment. No further action will be required if the trainee drops out halfway through the course.

The trainee would not be eligible for the IBF Standards Training Scheme (IBF-STS) / Financial Training Scheme (FTS) funding as the availability of the funding is subjected to the trainee’s successful completion of the IBF-STS / FTS course (including

passing all relevant assessments and examinations). Training providers are expected to have clear and transparent policies on recovery of fees for such cases, which you can rely upon for claw back of the course fees from such trainees (where applicable).

Q10. The trainees have to attend make-up classes and/or sit for make-up assessments. How do I administer make-up classes and assessment in TPGateway?

| Scenario | Steps for make-up classes / assessments

|

- Trainee did not sit for assessment;

- Trainee enrolled in Assessment-Only Pathway Programme (AOP)

| If the trainee is attending assessment from another existing course run (“make-up course run”) with “Assessment” session: Note that course run start date of make-up course run should not be earlier than that of

the initial course run start date which the trainee was enrolled in.

- Do not submit another enrolment for the trainee or re-tag the enrolment to the make-up course run

- Ensure trainee’s attendance is captured for the “Assessment” session within the attendance submission deadline for the make-up “Assessment” session

- Upload trainee’s assessment record(s) within the assessment submission deadline for the make-up course run Note that course run start date of make-up course run should not be earlier than that of the initial course

|

- Trainee missed course session(s) and did not sit for assessment

| If the trainee is attending make-up session(s) from another existing course run (“make-up course run”): Note that course run start date of make-up course run should not be earlier than that of the initial course

run start date which the trainee was enrolled in.

- Do not submit another enrolment for the trainee or re-tag the enrolment to the make-up course run

- Ensure trainee’s attendance is captured for the session(s) including “Assessment” session (if applicable) within the attendance submission deadline for each make-up session. The attendance record(s) will be added

to the attendance that was recorded in the initial course run the trainee was enrolled in

- Upload trainee’s assessment record(s) within the assessment submission deadline for the make-up course run (if applicable)

Note: If there is no existing course run for trainee to attend make-up session(s) for, please create a new course run and session(s) and follow the steps listed above. The course start and end date of the new course run should correspond with the start and end date of the make-up session(s) required from the trainee. |

- Trainee did not attend original course run he/she was enrolled in and requested to defer to another course run

| If the trainee is attending session(s) from a deferred course run:

Note that course run start date of make-up course run should not be earlier than that of the initial course run start date which the trainee was enrolled in.

- Cancel the trainee’s enrolment in the original course run

- Create a new course run and session(s) (if applicable)

- Submit a new enrolment for the trainee in the deferred course run

- Ensure trainee’s attendance is captured for the session(s) including “Assessment” session (if applicable) within the attendance submission deadline for each session

- Upload trainee’s assessment record(s) within the assessment submission deadline for the deferred course run (if applicable)

|

Source

Please note that for funding submissions to be processed, the training provider is required to submit the attendance and assessment records for the make-up session(s)/assessment(s) within the submission deadline i.e. within 120 calendar days from the

initial course run end date which the trainee was enrolled in.

Submission deadline

Before Course

| During Course | After Course

|

| Add Course Runs | Calculate Grants | Submit Enrolment | Upload Attendance | Submit Attendance |

| Maintenance of course runs and sessions for each approved course | Eligible grant amount for learners calculated based on enrolment details submitted by TPs | Learners can take self-attendance via QR code or TPs upload on behalf | Bulk upload of assessment for reduction in processing time |

| | Course Runs and Course Sessions

| Enrolment | Attendance | Assessment |

|---|

| Financial Training Providers | Before course start date[1]

| Enrolment must be submitted before or within 45 calendar days after course run start date | Attendance records and Assessment results must be submitted within 45 calendar days after course run end date[2]

|

[1] Course runs and course sessions must be created before course start date for the link to the QR code for attendance taking to be sent to the Course Administrator and Trainer.

[2] Applicable to manual attendance submission, otherwise all attendance should be taken digitally during the course run.

Q11. I did a bulk upload for course run/ enrolment/ attendance/ assessment in TPGateway but it was not

reflected in the system.

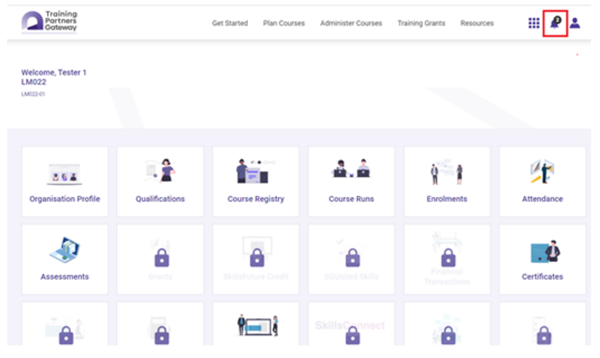

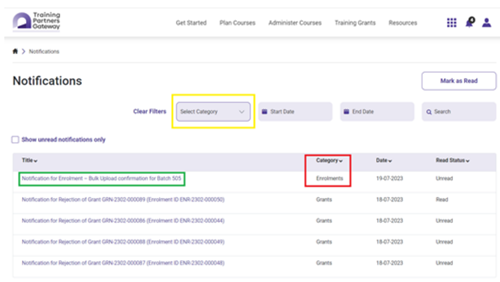

You may wish to refer to the guide below to check if there are any errors/failure messages for your uploads.

Step 1: Click on the bell icon

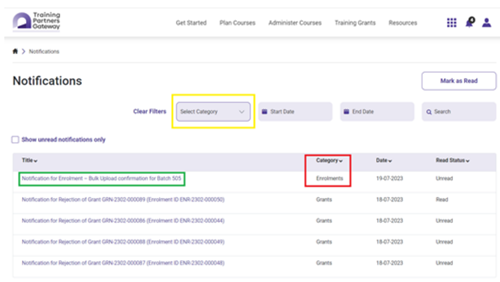

Step 2: Select the category of the upload using the filter function highlighted with yellow box. Then click into the hyperlink highlighted with the green box.

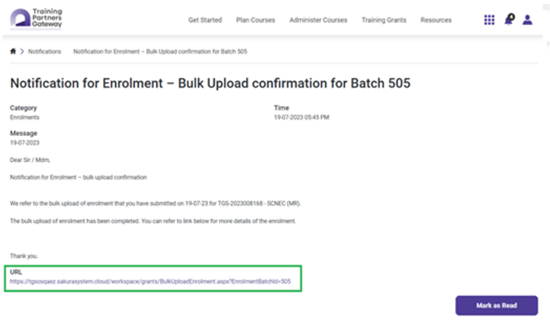

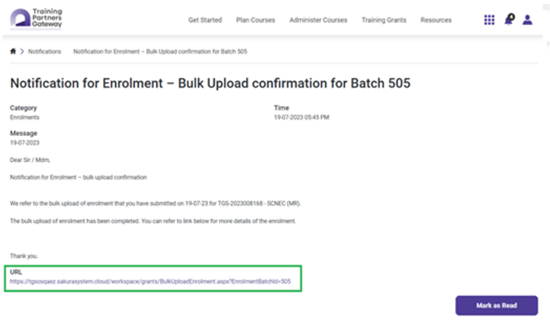

Step 3: Click on the URL highlighted with the green box.

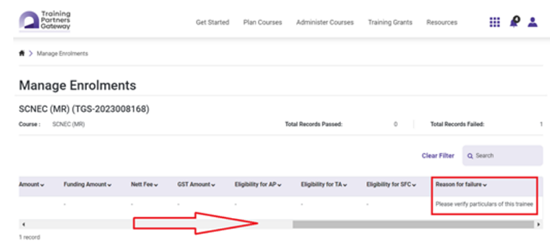

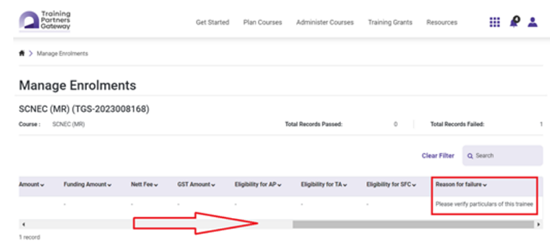

Step 4: Scroll through the task bar all the way to the extreme right to see the "Reason for failure".

Q12. How long will IBF take to process the funding support submission in TPGateway?

IBF will take approximately 6 to 8 weeks after the submission deadline for attendance and assessment records to process the funding support upon complete and accurate submission. Longer processing time may be required in certain cases (e.g. incomplete

or inaccurate submissions, Corporate PayNow not linked or nonstandard cases).

Example for FTP submission

Course run end date: 17 October 2022 Submission deadline for attendance and assessment records: 1 December 2022 (45 calendar days after course run end date) IBF processing timeline: approximately 6 to 8 weeks from 2 December 2022 |

Example for FI in-house submission

Course run end date: 17 October 2022 Submission deadline for attendance and assessment records: 30 January 2023 (105 calendar days after

course run end date) IBF processing timeline: approximately 6 to 8 weeks from 31 January 2023 |

Overview

Overview